If you are looking to drive a new model car for a short period, assuming a lease is a good idea. Lease assumption allows customers to take advantage of lower monthly costs and short leasing durations, which are not available often. Find out more about the benefits of assuming a lease and its process at eAutoLease.com to make a good deal. With comprehensive information and a huge variety of vehicles, you can look forward to driving the car you had eyes on without getting into a traditional long term lease.

Helpful References About Car Leasing:

- Best Volkswagen Lease Programs

- Kia Lease Options

- Jeep Lease Prices

- Hyundai Lease Specials & Discounts

- Acura Lease Specials

- Mazda Lease Offers

Lease assumption – what is it?

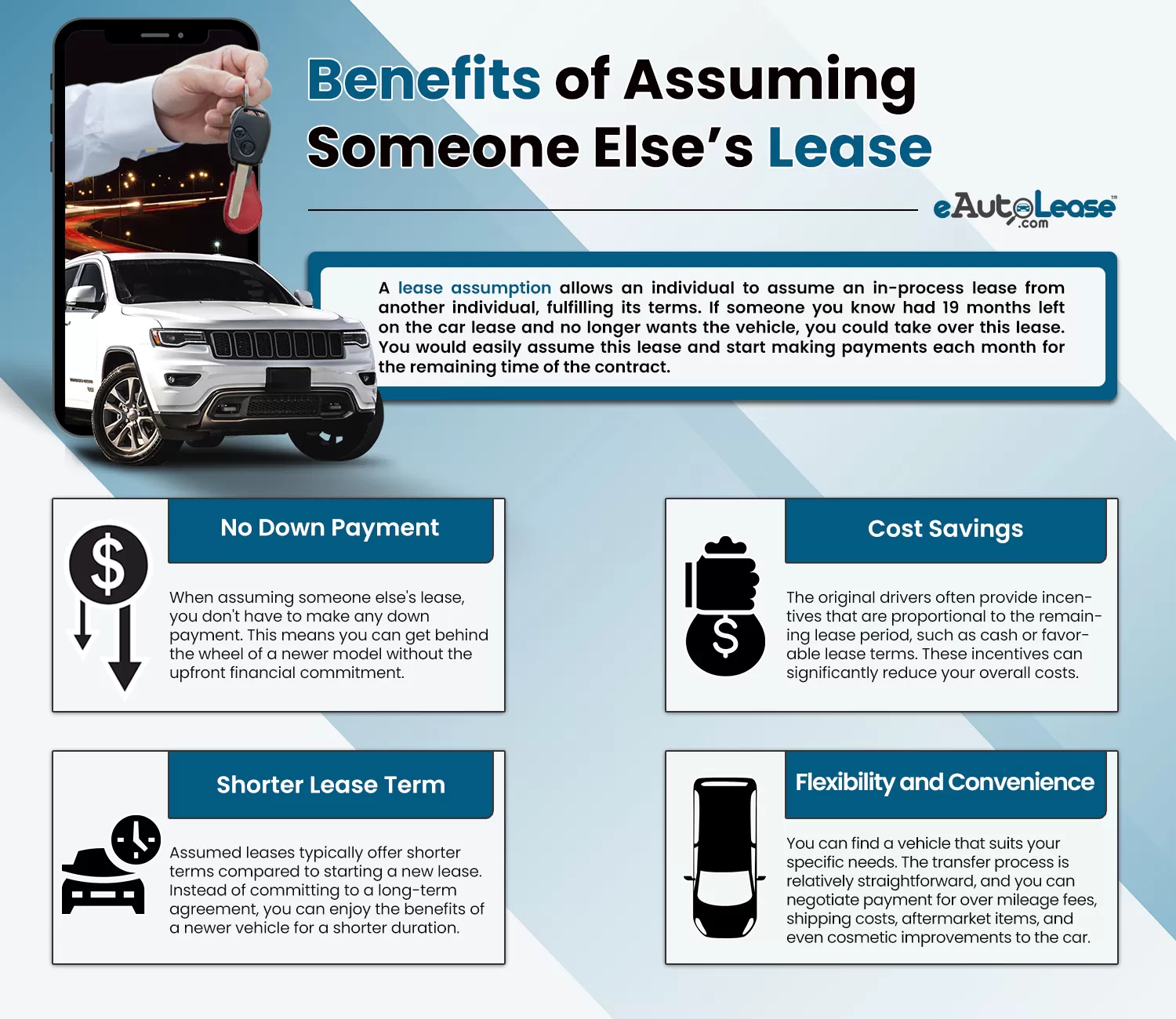

A lease assumption allows an individual to assume an in-process lease from another individual, fulfilling its terms. If someone you know had 19 months left on the car lease and no longer wants the vehicle, you could take over this lease. You would easily assume this lease and start making payments each month for the remaining time of the contract.

At the end of the contract, you would return the car to the leasing company just as you would if you had leased the vehicle new. The process is simple and easy to understand and offers benefits and financial incentives when done right.

Read more: Selling A Leased Car

Benefits of assuming someone else’s lease

Assuming a car lease has several benefits if you want to drive a newer model for a short time. As the person taking over the lease, you don’t have to make any down payment. Also, you get a shorter lease term than you would if you were to get a whole new lease. In most cases, finding a short-term lease is difficult as the average lease term ranges over 40 months.

The best thing about assuming someone else’s lease is that you can save thousands of dollars and only require a short-term lease agreement. Usually, sellers or people looking to hand over their leases offer incentives to buyers, such as cash or other terms, to make the deal exciting. These incentives are usually in proportion to the period of the lease, and the intentions of the seller.

Why would a buyer want the seller to assume a lease?

The seller or the existing leaseholder is already bound to a leasing contract for the duration of the term. If they want to exit their lease early, they would have to pay thousands of dollars in early termination as penalties to the leasing company.

The leasing company does not offer any incentive to the seller to return the vehicle. They lose thousands of dollars when a vehicle is returned early, and they don’t want this. The best way for sellers to avoid paying heavy penalties in case of early termination of a lease is by looking for someone who is ready to assume a lease, allowing them to walk away without paying heavy penalties. Sometimes sellers also offer cash incentives to the buyer to make their deal more attractive than a new lease or competing offers.

Remember, when signing a lease, you are contractually obligated to the leasing company for the entire lease term. It is not a monthly rental, which means you are not only obligated to pay every bit of money but the entire lease amount, which adds up to thousands of dollars.

What to look for in a lease transfer?

As a buyer, you should look for a vehicle with a low monthly payment, at least 1,000 miles per month available to drive, and near your area. A short-term lease is also good, but if you plan to keep the leased vehicle for some time, you may be searching for a slightly longer term.

If you look carefully, you may find a great deal, most suitable for your situation. Make sure to focus on all aspects, including the residual value and the allotment of miles left on the lease term.

Keep an eye on the following to ensure you are getting a good deal:

- Monthly payment – Check out if the price is lower than what a new lease would cost. If not, you do not have to put any money down on this lease. The monthly payment on a lease assumption is greatly impacted by cash incentives and other offers.

- Cash incentive – Sellers provide cash incentives to buyers to make the lease more attractive. These incentives can be anything from single-month payments to thousands of dollars in cash. It may also be a lower monthly payment listed, including the cash incentives, which means the actual amount may be higher than listed. It is best to check with the seller and ask questions about it before proceeding with the deal.

- Location – Check out the proximity of the vehicle. If it is not near, there are several options. Some people prefer to pick up the vehicle by flying or driving to the car and taking it home. If these options do not work for you, the vehicle can also be shipped nationwide for a fee.

- Miles allowed – This is different for every vehicle and must be reviewed carefully. If the seller has more miles available per month than the average lease, such a lease is worth more if you plan to drive lots of miles.

- Lease end buyout – Also known as the residual price, it is the amount for which the vehicle is available for sale at the end of the lease. You may find a great price on a car at the end of the lease. At times, the lease-end buyout may be very high, which means it will cost you a lot more if you want to buy the vehicle after the lease ends.

Connecting with the seller

Assuming a lease should not be taken lightly, and as a buyer, you must make an effort to know the lease terms to avoid any problems later on. Whether you talk on the phone, on the web, or meet in person, there are questions you must ask before negotiating a lease assumption.

If the car is not available to preview in person, you must ask questions to learn more about its condition to ensure it is fairly represented.

Questions you should as a lease seller

Here are some important questions you must ask a lease seller before assuming a lease.

They include:

- What is the condition of the car? Does it have any dents, dings or scratches, or stains in the interior, or any scratches or dings in the windows?

- Has the car been smoked in?

- Do you transfer pets in the car?

- What is the most current odometer reading?

- Is the payment inclusive of taxes? Is it modified at all from the original lease contract?

- Are there any options or features that have not been listed in the ad?

- How much wear is left on the tires?

- How many miles have you driven the car? What are the over-mileage fees on the vehicle?

- Is there any cash incentive with the lease? It can be in the form of one or two payments, flat cash settlement at signing, or cash amount to account for potential over mileage.

- Is there an accident report available for this vehicle?

Asking these questions will give you an idea about the vehicle you will be driving and help you handle the lease better.

Negotiating a deal

Negotiating your lease assumption with a seller is a crucial move, and you must not hesitate to bargain. Sellers are often willing to negotiate the terms of the transaction than you think. Nothing is set in stone, but you should understand what is and is not up for discussion.

While cash incentives, payment for over mileage fees, shipping costs, and aftermarket items like speakers, stereo, and cosmetic improvement are negotiable while terms of the lease, over mileage fees, taxes, and lease end buyout are usually not negotiable.

You can have a face-to-face discussion with the seller, talk on the phone or connect through email. It is not unreasonable to ask the seller for some incentive if the deal is not already below market. It can be anything that works to your advantage.

Fees you may have to pay when assuming a lease

You may have to pay some fees when you are assuming a lease. They are relatively few and inexpensive.

Registration fee – Some service providers require a fee to facilitate a lease transfer.

Credit application fee – You may have to pay a credit application fee to the leasing company with which you are assuming a lease. It may or may not be refundable, depending on the leasing company.

Vehicle inspection – This charge is not necessary but recommended. It is best to have your vehicle inspected by a third-party vehicle inspection service before assuming a lease. These services cost about a hundred dollars and are worth the investment.

Transportation – You may, or may not require special transportation of the vehicle to where you live.

Vehicle registration – You will have to register the vehicle once you get it. Check with your local Department of Motor Vehicles to determine what vehicle registration charges apply in your area.

Read more: How to Lease a Car Through Your Business

How to start the lease transfer process

Once the seller and the buyer have reached an agreement regarding the deal, the next step is the lease transfer process. This process can be completed anywhere between one to three weeks, depending on you, the seller, and the leasing company.

The leasing company requires you or the new lessee to have good or better credit than the person you are assuming the lease from. It wants to ensure you are a reliable potential customer and will continue paying the monthly payments regularly. It has been observed that leasing companies do not lower their credit expectation for lease transfers.

Contact the leasing company you want to transfer your lease through and ask for a lease transfer application. This application is similar to a new lease application. Once complete, you send this application back to the designated mailing address. The leasing companies review your application and contact you directly regarding your status. After getting approval, you can start the Lease Transfer Paperwork.

The Lease Transfer Paperwork – what is it all about?

Once the buyer gets approval for a lease transfer, the leasing company will send the appropriate transfer paperwork to both parties. This information is usually sent directly to the seller as they are the party that is legally bound to the vehicle. After the paperwork is received, the buyer and seller arrange to either meet or initiate the paperwork signatures through email.

In case of a long-distance transfer, the seller arranges transport with the buyer before the final signing of the lease paperwork. It is essential as the buyer cannot be fully assured that the vehicle is in its stated condition until it is inspected. When the vehicle is delivered, the buyer must agree to sign the paperwork within a stated period or ship the car back.

Agreeing to a Third Party Inspection Service before shipment is the best course of action in case of a long-distance transfer for both the buyer and the seller. It only costs a hundred dollars and helps in making the right decision.

You must remember, the car is not yours until you sign and notarize the transfer of paperwork. When the vehicle arrives or when the buyer goes to see it, the transfer papers are signed at this time. A Notary Public is required to approve the signatures, so make sure you are near a bank or other location of one of these officers.

Once the documents are signed by both parties, the Lease Transfer Paperwork is sent back to the leasing company, and the buyer becomes the lease owner. The next step is registering the vehicle and transferring the license plates. Experts recommend getting the vehicle transferred and registered as soon as possible to avoid any issues. Also, it is best to get the new vehicle insured in your name to be on the safe side.

What to do at a lease end?

You must check with the leasing company to find out what to do at the end of the lease. Even though you are assuming the lease from the original lessee, the leasing company maintains the ownership of the vehicle. Some leasing companies ask the lessee to deliver the vehicle to the local dealership, while others ask to drop it off at a designated auction lot.

The leasing company will inspect the vehicle at the drop-off point for wear and tear. Make sure to repair extended damage before handing over the vehicle to avoid paying premium fees charged by the leasing company for such repair work.

Depending on your situation, taking over someone else’s car lease can be a smart move, as it could come with lower monthly costs and expanded vehicle options compared to buying. However, you must remember that the responsibility you are taking over is greater than a typical auto lease, as you are taking over the lease from the original driver. Check out eAutoLease.com to learn more about the process of assuming a lease and explore your options to get the best deal for your budget.