If you are not sure whether leasing is worth the effort, use a car lease calculator to estimate your monthly auto lease payment and determine if it will work for you. Visit eAutoLease.com to find out more about leasing and to make the auto-leasing process easier. You can look forward to finding the best deals, and the right loan term with the help of incentives and rebates that no one will tell you about.

Explore More About eAutolease Cars:

- MINI Lease Options

- Bentley Leasing Deals

- Aston Martin Lease Offers

- Tesla Lease Price

- Mitsubishi Lease Specials

- Best Maserati Lease Deals

Leasing a car may be the best option if you prefer to get behind the wheels of the latest car model. Using a car lease calculator can help you work out the cost of a car lease in the long and short term, determine how much you will pay, and find a lease that works with your budget and lifestyle most successfully.

Calculating auto lease payments – key figures

Calculating a monthly lease payment is a game of figures. While some of these figures are negotiable, others are set by the lender.

The following figures have the biggest impact on your monthly payment:

- The negotiated sale price of the car

- The resale value of the car, which is its predicted value at the end of the lease

- The interest rate

- The length of the lease

The sale price of the car – Although you are not purchasing the car at this time, you can still negotiate its sale price to lower your monthly payment. Check the current market value of the vehicle on any pricing guide, and you will know how much it is worth.

Resale value – Also called the residual value, it is the total worth of the car at the end of the lease. It is set by the lender and remains non-negotiable. You will get the specific residual value from the dealer, but a resale value between 50% and 58% is used for most cars.

Interest rate – The interest rate is also called the lease factor or money factor. When calculating a monthly lease, the interest rate is converted to decimal to figure out the monthly payment. 3% interest would be written as 0.00125, or you can convert a lease factor into an interest rate by multiplying it by 2,400. The rate you get is based on your credit score. Different lenders or vehice leasing companies offer different interest rates, but it is usually between 2 and 5% for strong credit, between 6 and 9% for average credit, and between 10 to 15% for poor credit. Interest rate is an important aspect you should consider before leasing a car.

Length of the lease – Usually car leases last about 36 months as this is how long most warranties last. It means you don’t have to pay extra for extended coverage and your maintenance cost will remain low as the car is new. Avoid getting a four or five-year term as you may end up with costly service and repairs.

Read more: Three Things to Know About a Short-Term Car Lease

Some other factors that affect your monthly payments

There are some other factors too that can have an impact on how much you will be paying every month. A few of them are set by the leasing company but you can also choose some of them.

They are:

- Drive-off fees – It is just like a down payment when you buy a car. It comprises several fees and is also called a capitalized cost reduction. You can select any drive-off amount you want. Experts recommend starting the lease with a drive-off payment of $1,000. Making a higher payment upfront can reduce your monthly payments and cash flow for other things like investment.

- Cash rebates and incentives – If a car is not selling quickly, the manufacturer may offer rebates and incentives and reduce the monthly payments of a lease. These are known as lease specials and help you get a good deal.

- Included miles – Usually lease contracts allow 12,000 a year but you can find leases for mileage as low as 5,000 miles. Ultra-low mileage leases provide less value which means lower monthly payments. Similarly, high mileage lease will cost more, but it is a good option if you drive a lot and want to avoid paying excess mileage charges.

- Sales tax – The best thing about leasing is that you pay sales tax only on the amount of the car’s value you use and not the total purchase price.

How to use a car lease calculator?

With all the right information, you can calculate your monthly payment easily. Put in the figures that best suit your financial situation and lifestyle, different drive-off amounts, and see how it changes the monthly payment. Do not put too much money down as it defeats the leasing advantage of preserving cash flow.

Auto lease calculator example

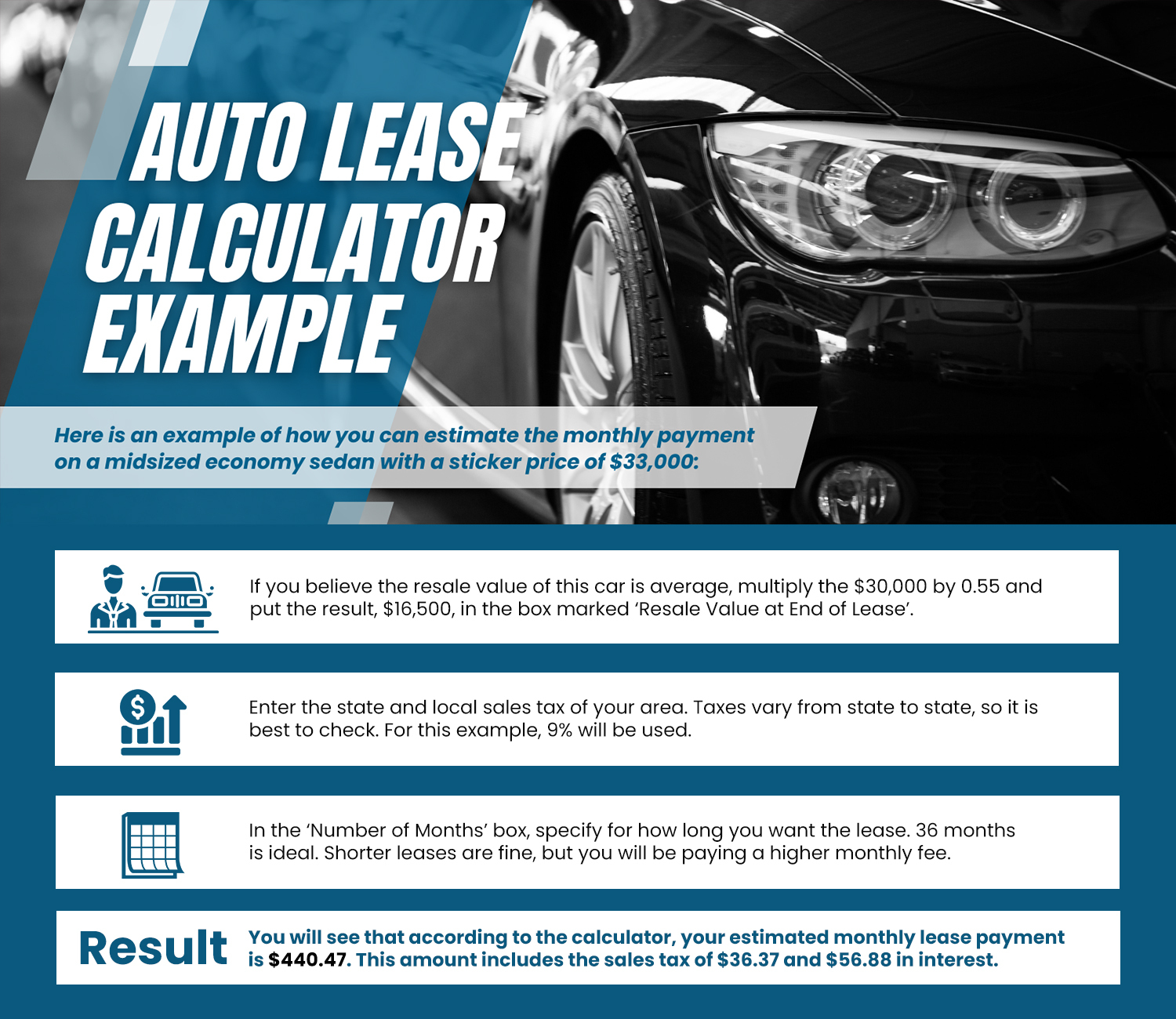

Here is an example of how you can estimate the monthly payment on a midsized economy sedan with a sticker price of $33,000:

- Start by checking prices with reliable and renowned guides online. You may find that you can buy the car for $30,000 so put that in the box marked ‘Car Price’.

- Determine how much you want to pay in down payment or drive-off fees. Put that in the ‘Down Payment’ box.

- If you believe the resale value of this car is average, multiply the $30,000 by 0.55 and put the result, $16,500, in the box marked ‘Resale Value at End of Lease’.

- Enter the state and local sales tax of your area. Taxes vary from state to state, so it is best to check. For this example, 9% will be used.

- Put in the interest rate you think you will qualify for based on your credit history. If you are not sure about your credit score, check it before moving forward. Enter the interest rate as a percentage. 3% can be used initially.

- In the ‘Number of Months’ box, specify for how long you want the lease. 36 months is ideal. Shorter leases are fine, but you will be paying a higher monthly fee.

Result

You will see that according to the calculator, your estimated monthly lease payment is $440.47. This amount includes the sales tax of $36.37 and $56.88 in interest.

Read more: Is Buying Out Your Auto Lease Right for You?

How do car lease calculator results help you?

Determining your monthly payment with a lease calculator gives you a chance to start shopping for the most suitable. Go through a car leasing guide to request lease quotes from local dealers. With an estimated monthly payment from the lease calculator, you will make a better choice.

When you compare notes, make sure the monthly payment is based on the same number of months, down payment, included miles, and interest rate. If these figures change, the monthly payment also goes up and down.

In addition to this, ask your salesperson for a breakdown of all the numbers, especially the interest rate and residual value, on which the quote is based. Also, check for yourself and see what you get. It may come as a surprise that some quotes from dealers are well below the number estimated using the calculator. It may be due to a discount price by the dealer, special financing from the manufacturer, or a stronger residual value than you estimated. At times manufacturers also play with the leasing formula to offer a discounted monthly payment, also referred to as a subvented lease.

If this is the first time you are leasing a car and not sure about what to do, there is no need to worry. You can make the right decision by focusing on your driving needs, budget, and how much you can pay each month. eAutoLease.com helps you estimate your monthly car payment on a new car or truck lease and ensures you prepare yourself to negotiate with a dealer, customize your lease and enjoy a great driving experience.