If you want to drive a new car every three to four years, leasing can be a cost-effective way for you to enjoy driving the model of your choice. The average monthly payment for leasing is lesser than if you choose to finance a car. Visit eAutoLease.com to find out more about what is leasing and how much it costs to lease a car. With the right information on leasing and market trends, you can get a vehicle to suit your needs.

Explore More About eAutolease Cars:

- SUV Leasing Special Offers

- BMW Lease Specials near me

- Best Audi Lease Prices

- Toyota Leasing Deals

- Honda Lease Options

- Lexus Lease Specials

The cost to lease a car varies as it depends on the type of vehicle you like. It also includes the vehicle’s estimated deprecation over the lease term, rent charges, taxes, and fees. Before deciding if leasing is the right option, check out how it works, how much you are expected to pay, what factors determine your payments, and what types of fees come with it.

How does car leasing work?

Leasing a car is like borrowing it for a set term and paying a fee for using it. The agreement signed between you as the lessor outlines the length of the lease, monthly payments you will make and the maximum number of miles you can drive per year, and other terms. At the end of the lease, you have the option of purchasing the vehicle or returning it.

When you return the car, your car dealer will inspect it to ensure it is in good shape. If it is damaged beyond normal wear and tear, you will be paying for the repairs.

Read more: What Is The Residual Value of My Lease

Why lease payments are cheaper than loans?

If you decide to finance the purchase of a vehicle with a car loan, you are committing yourself to repay the full value of the car, as well as the interest, over the term of the loan. In most cases, this loan term is five years. On the other hand, when you lease a vehicle, you are only committing to paying for a portion of the car’s value deprecation over that same period of time.

For some people, leasing may be a better option than buying. Reasons include:

- Newer vehicle every time you lease – When you lease, you get a chance to drive a newer car than you could afford otherwise. With the latest model, you can enjoy the best features, safety, and convenience.

- No hassle of maintenance – Leased cars are generally new, which means there will be no need for costly repairs. You will only have to pay for routine maintenance, such as oil changes. As your lease term is likely to end before the car needs any major work or new tires, it reduces the hassle of maintenance. Some leases also cover maintenance costs as part of the contract.

- Lower monthly payments – The monthly payments for a lease are less than what you would be paying if you purchased the same vehicle with a car loan. According to experts, the average monthly payment for a financed car is $667, or $127 higher than the average monthly payment for a leased vehicle.

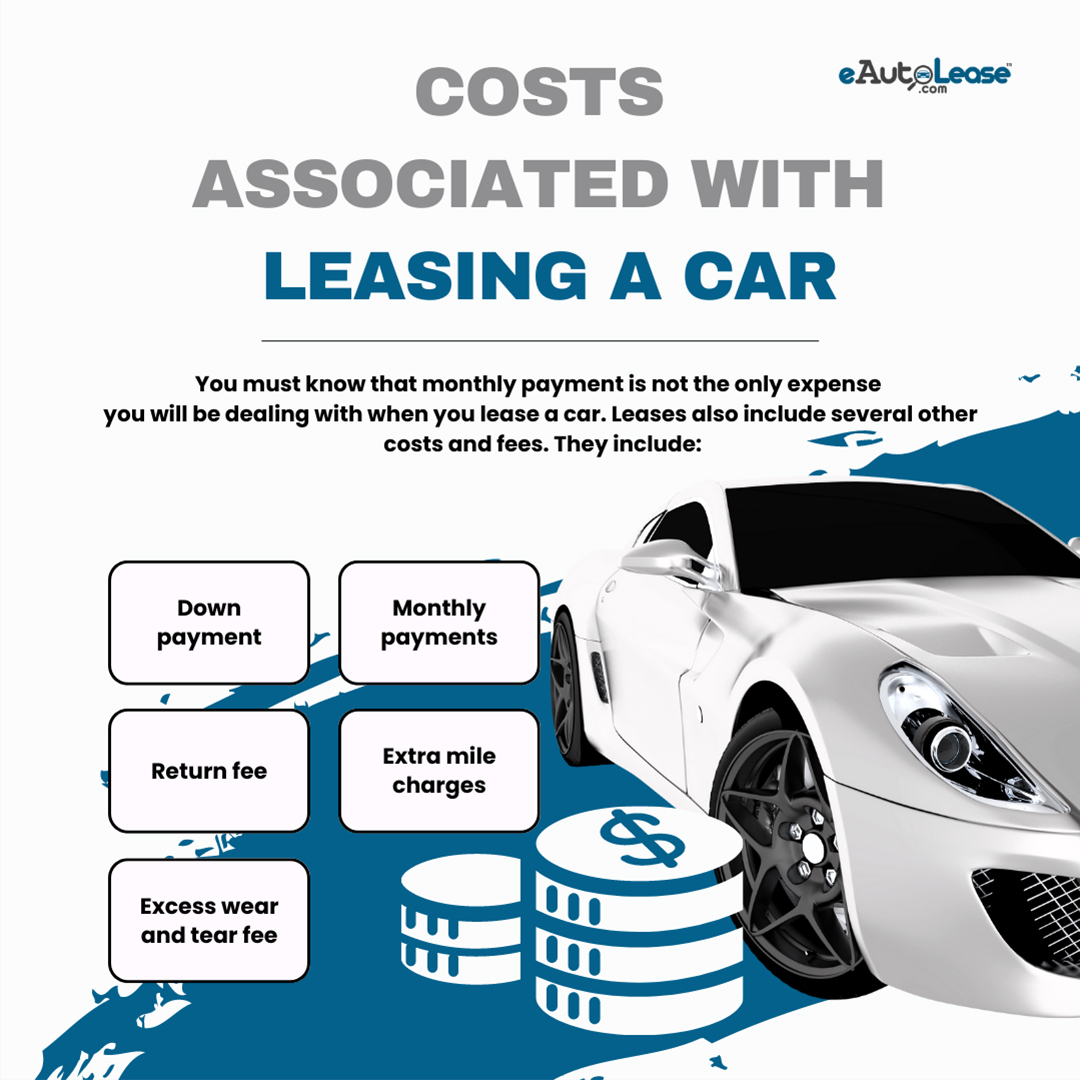

Costs associated with leasing a car

You must know that monthly payment is not the only expense you will be dealing with when you lease a car. Leases also include several other costs and fees. They include:

Down payment

Sometimes also known as a capitalized cost reduction, a down payment can vary depending on your location, the dealer, the value of the car you have selected, and any promotions going on at that time. This amount can range anywhere from $0 to several thousand dollars.

Monthly payments

You will pay a monthly fee for using the car. These monthly payments are based on the value of the vehicle and its expected deprecation during the lease term. You can keep the monthly payment down by making a larger down payment or trading in a vehicle.

The first monthly payment is usually made when you sign the lease agreement. This payment is in addition to the down payment.

Return fee

It is also known as a disposition fee and comes at the end of the lease term when you bring the vehicle back to the dealership. The return fee pays to clean and repair the vehicle before returning it and is usually about $350.

Extra mile charges

Usually, lease agreements include an annual mileage limit, such as 12,000 to 15,000 miles per limit. If your return the car at the end of the lease with more miles than the maximum limit, you will have to pay extra mileage charges.

Depending on the type of car you leased, extra mile charges can range from 10 cents to 25 cents per mile. If you leased a car with an annual mileage maximum of 12,000 miles and a three-year term but returned it with 40,000 after the lease, 4,000 miles above the agreed-upon limit, you will be charged for the extra miles used. If your contract states 20 cents per mile over the limit, it means you will pay $800.

Sales tax

A majority of states require you to pay taxes only on a portion of the car (the depreciated amount you use up throughout the lease). These taxes are conveniently included in your monthly lease payment. No upfront payments to fret over. However, rules differ across states. In places like Illinois and Texas, the full vehicle amount is subject to sales tax. What’s more, in certain states, you may need to pay the tax upfront. The catch is that these regulations are always changing. It’s best to contact your state’s DMV for further information on the situation in your state.

Documentation, tag, title, registration, and license fees

In leasing, as in regular car purchases, there’s a mix of dealer and state fees you need to reckon with. Dealer documentation fees can fall anywhere between $50 and $695. On the other side of the spectrum, state and local fees are the real deal, mandatory contributions to government agencies. They cover essential aspects like tags, titles, registrations, and licenses.

Read more: Pros and Cons of Taking Over Car Lease Payments

Excess wear and tear fee

Even though regular wear and tear are included in the lease, excessive damage is not. If you return the car with dents, scratches, stains to the upholstery, worn tires, and cracked glass, or if you did not follow the vehicle’s maintenance schedule, the dealer can charge you more.

You may be asked to pay the full cost of repairs, or there may be a cap on how much the dealer can legally charge you.

Which one is a better financial option – leasing or financing a car?

Deciding to lease or finance a car depends on your financial needs and goals. Monthly payments on a lease are usually less than those on a car loan.

Not owning the car when the lease ends is a disadvantage for some people. In addition to this, the mileage restriction and associated fees, if you exceed them, may inhibit your use of the car. There are many other costs you must account for in addition to the monthly payment. Ultimately, you pay more for leasing than if you buy a car and use it for years.

Does leasing really work?

Leasing makes sense for people who just want a car for a short period without buying it, need to have a new car after every few years, or do not have sufficient finances to purchase one. As the monthly payment is less than the can loan on the same vehicle, it is an attractive prospect for many. If you can stay under the annual mileage cap, avoid excess wear and tear, and follow the terms specified in the lease, leasing is a good option.