Choosing between buying and leasing a car is a tough decision if you are in the market for a new car. While buying may involve higher monthly costs, you become the vehicle owner in the end. On the other hand, a lease has lower monthly payments and gives you a chance to drive a vehicle that may be more than you could afford, but it gets you into a cycle in which you never stop paying for the vehicle. eAutoLease.com helps you get the best deal on the right car by exploring the pros and costs of leasing vs. buying a car. Call now for the best leasing deals and latest offers to get the vehicle of your choice.

Before deciding if you should lease or buy, it is necessary to understand the key differences between the two to assess which one will suit you best, considering your finances and driving habits.

Read more: End Your Car Lease Early: Sell, Swap, or Buy

Lease or Buy a Car: What Is the Difference?

Buying a Car

Buying a car the conventional way is easy. You get a loan from a bank, credit union, or any other lending company and make monthly payments for some years. A chunk of each payment goes into paying interest on the loan, while the rest is used to pay down the principal.

It is important to note that the higher the interest rate, the higher is the payment. As you repay the principal, you built equity until the car is all yours by the end of the loan. You can keep the car for as long as you like and treat it as you want. You maintain control over all aspects of the vehicle and can keep it, trade it, sell it, or even give it away, as you want.

Leasing a Car

Leasing a new vehicle is an alternative to buying it as car prices continue to increase. With a lease, you can make monthly payments to drive a new car for a specific period of time. The average lease is 24 or 36 months, although you can find even longer leases. The payment is often less than the monthly cost of financing a new vehicle, but buyers must return the car when the lease term comes to an end.

Restrictions apply to how many miles you can drive and modifications you may wish to make. As more people are now working from home, the mileage restrictions on a lease may not be a factor for many. On the contrary, many people find they do not use the miles they have paid for.

Once the lease period ends, you have the option to return the vehicle to the dealer or purchase it at a predetermined amount, as defined in the lease contract.

For some people, the predictability of payments and ownership costs has its appeal, such as no expensive repairs when under warranty. However, life can be unpredictable, and in some cases, the lease has less flexibility than a purchase.

To find out which will work best for you, let us take a look at the pros and cons of each.

Pros of Leasing

Leasing seems to be more appealing than buying at certain levels. The monthly payments are usually lower as you are not paying any principal. On the contrary, you are just borrowing and repaying the difference between the value of the car when new, and its residual, the expected value when the lease ends, as well as the finance charges.

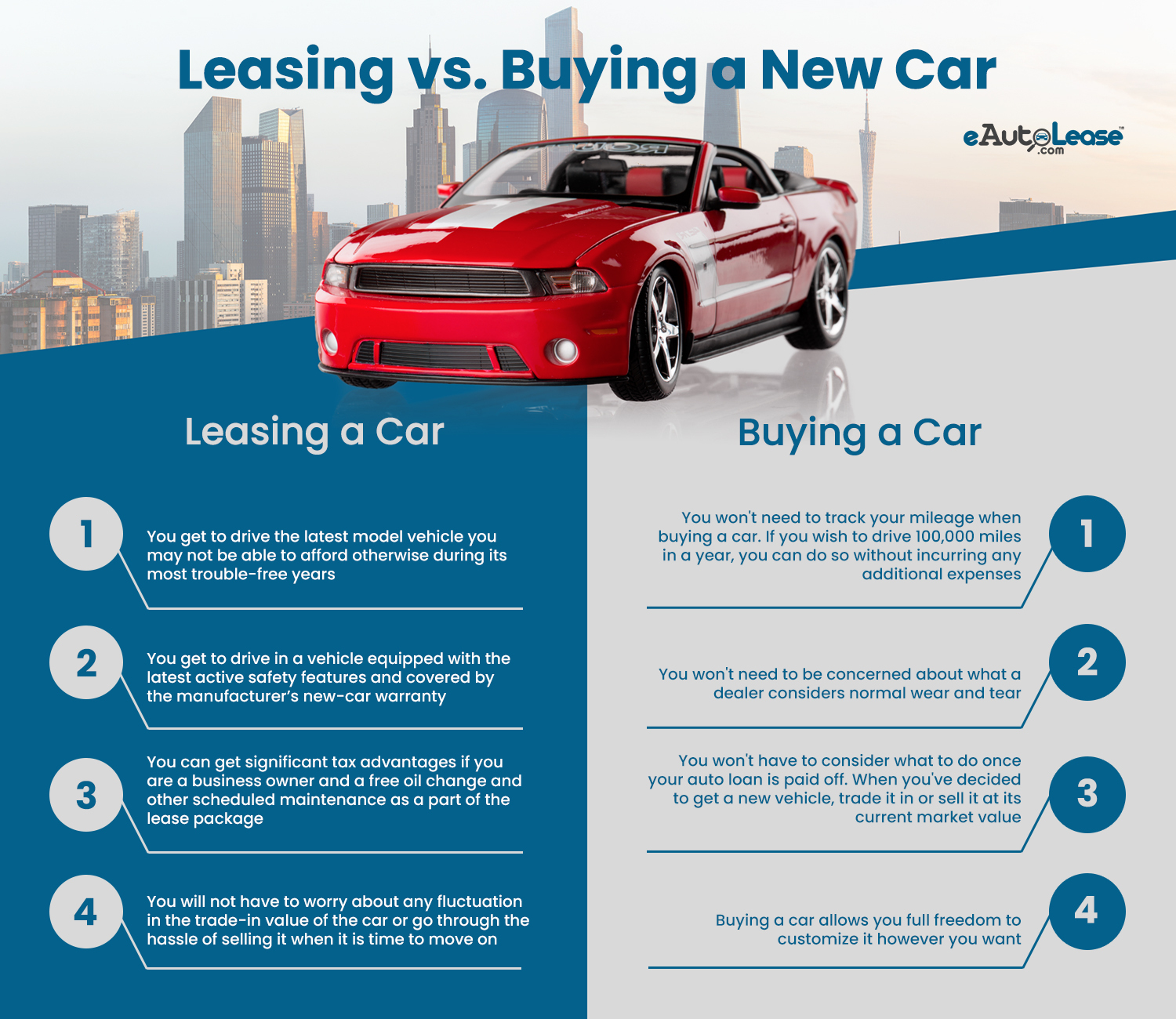

Top Advantages of Leasing

- You get to drive the car during its most trouble-free years

- You get to drive the latest model vehicle that is usually covered by the manufacturer’s new-car warranty

- You may get a free oil change and other scheduled maintenance as a part of lease package

- You can drive a higher-priced, better-equipped vehicle you may not be able to afford otherwise

- You get to drive in a vehicle equipped with the latest active safety features

- You will not have to worry about any fluctuation in the trade-in value of the car or go through the hassle of selling it when it is time to move on

- You can get significant tax advantages if you are a business owner

- You can just drop off the car at the dealer if you are done driving it at the lease end

Disadvantages of Leasing

Despite the advantages it offers, there are several disadvantages to leasing:

- Leasing usually costs more than a loan as you are paying for the car when it is most rapidly depreciating.

- If you keep leasing one car after another, monthly payments can go on forever. On the other hand, the longer you keep a vehicle after paying off its loan, the more value you get out of it. The cheapest way to drive a car is to buy and retain it until you want to change it or it demands expensive repairs.

- Almost all leasing contracts put a limit on the number of miles you can put on the car over the lease period. If you go over that limit, you will have to pay an excess mileage penalty. Usually, the fee is somewhere between 10 and 25 cents for every additional mile. You must be sure of how much you plan to drive as you don’t get credit for unused miles.

- If you fail to maintain the vehicle and keep it in good shape, you will have to pay a wear and tear charge when you return it. If you have small children or collect a lot of dents and dings, be prepared to pay extra.

- If you decide that you don’t like the car or cannot afford its payments, it might cost you. You may end up with thousands of dollars in early termination fees and penalties if you decide to get out of a lease early, and they will all be due at once. At times these charges can equal the amount of the lease for its entire term.

- You need to bring the car back in the condition as it left the showroom when the lease ends, with just a few exceptions, such as professional window tinting. It should be free of all wear and tear and configured just like when you leased it.

- You will still be responsible for expandable items such as tires, and they can be more expensive to replace on a better-equipped vehicle with premium vehicles, which is not so easy.

- You may also have to pay a fee when you return the vehicle when the lease comes to an end.

Alternative to Long Car Loans

Buyers who are not so keen on longer car loans of six to eight years consider leasing a better option. Even though longer car loans offer lower monthly payments, they can be risky and are not the first choice of many people.

Longer loans make it easy to get upside down as you may end up owing more than the vehicle is worth and stay this way for a long time. If you need to sell or replace the car early or if it is stolen or destroyed, the trade-in, resale, or insurance value will be less likely than you still owe.

Buying a car with a loan is not the way to go if you want to drive a new car every couple of years. Taking out long-term loans and trading in early leaves you paying so many finance charges, as compared to the principal that you would be better off leasing. If you cannot pay off the difference on an upside-down loan, you can often roll the amount you still owe into a new loan. You may end up financing both the new car and the remainder of your old car.

If you are looking forward to having low monthly payments and driving a new vehicle every few years without any hassle, leasing may be worth the additional costs. However, it is essential to make sure that you understand this and are ready to live with all the limitations of mileage, wear and tear, and others.

Comparing Car Loans and Leases

The comparison between car loans and leases is a difficult one. Deciding if a six-year loan or a standard three-year lease will work better for you can be challenging. At the point the lease ends, the bank borrower still has three years of payments to go, but you have to look for another car or maybe even take the buyout offer.

The good thing about a lease is that it can also be subsidized or subvented. The automaker takes money off the top with an extra rebate just for lease deals, raises the residual, or even both. The automaker may also offer extra rebates on lease deals, which may not be available if you get a loan. Along with this, the interest rate on a lease may be different from the interest rate offered on a loan, which makes it very tough to compare the two.

Generally, two back-to-back, three-year leases can cost thousands more as compared to buying a car, either with a loan or cash, and owning it over the same six-year period. In such a case, savings increase for car buyers if they continue to hold on to the car for another three years, making it nine years in total, including maintenance and repairs.

If you are not happy with the limitations of the lease, you can think about purchasing a less expensive new car or a well-maintained used car. You can get a certified pre-owned vehicle from a franchise dealer or a long-term loan in such a case. Remember, whether you get a new car with cash, a loan, or a lease, you can end up saving money by choosing one that holds its value well, stays reliable, and offers good fuel economy.

You can save upfront and over a longer period by buying a used car and paying cash.

Read more: What Happens at the End of a Car Lease?

Negotiation Is the Key

Do not think the monthly payment printed in the leasing ad is final. You can negotiate and get a better deal. The figure mentioned in the ad may be based on the manufacturer’s suggested retail price, but it can be negotiated just as if you purchase the vehicle and save some money.

However, it is essential to note that the best deals are reserved for people with good credit, and they may find them cheap as the automaker wants to clear the deck of slow-selling vehicles but with the right lessors.

Buying or Leasing a New Car – Which Is the Right Option?

There are pros and cons to buying and leasing a new car, all depending on what works for you. If you cannot understand what to do, consult an expert to find the best option.

Nearly every driver searching for a new car faces the same big question; is it better to lease or buy? While there is no universal answer to this, determining your priorities can help to make the right decision. Whether you want the best deal financially, seek the luxury of getting behind a new set of wheels every few years or the best vehicle you could buy in your budget, eAutoLease.com can help you. You can look forward to getting the best deal on the right car, leasing, or buying as it works for you.