Leasing is a great option for many drivers. It works well for people not interested in owning a car right now or who prefer to drive newer vehicles. Finding out how leasing works and what restrictions it imposes can help you make a wise decision and enjoy the best deals. Check out eAutoLease.com to learn about the basics of car leasing, how it works, and how a car lease can impact your car insurance.

If you like driving a new car every few years, leasing can be an attractive option. It is similar to a long-term rental. You will make an upfront payment, plus monthly payments, and get to use a car for several years. At the end of the lease, you return the vehicle. You can also decide if you want to start a new lease, purchase a car or go carless.

Read on to find out how a car lease works and if it may be the right choice for you.

What is a Car Lease?

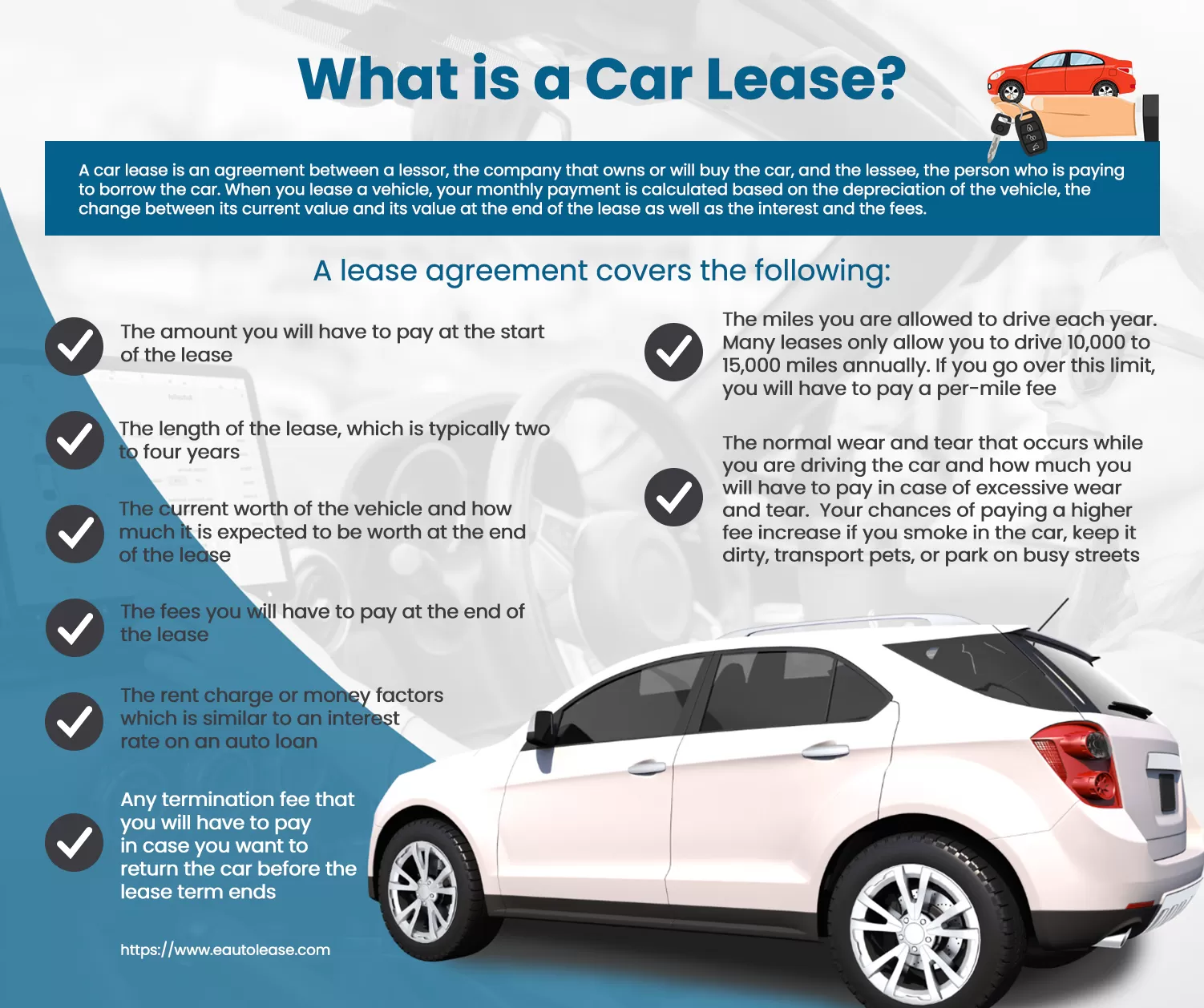

A car lease is an agreement between a lessor, the company that owns or will buy the car, and the lessee, the person who is paying to borrow the car. When you lease a vehicle, your monthly payment is calculated based on the depreciation of the vehicle, the change between its current value and its value at the end of the lease as well as the interest and the fees.

A lease agreement covers the following:

- The amount you will have to pay at the start of the lease

- The length of the lease, which is typically two to four years

- The current worth of the vehicle and how much it is expected to be worth at the end of the lease

- The fees you will have to pay at the end of the lease

- The rent charge or money factors which is similar to an interest rate on an auto loan

- Any termination fee that you will have to pay in case you want to return the car before the lease term ends

- The miles you are allowed to drive each year. Many leases only allow you to drive 10,000 to 15,000 miles annually. If you go over this limit, you will have to pay a per-mile fee.

- The normal wear and tear that occurs while you are driving the car and how much you will have to pay in case of excessive wear and tear. Your chances of paying a higher fee increase if you smoke in the car, keep it dirty, transport pets, or park on busy streets.

Read more: Mistakes to Avoid When Leasing a Car

What Happens If You Miss a Lease Payment?

Some rules may seem restrictive, but remember, you don’t own the vehicle. The lessor keeps the title, and you have to return the car in good condition at the term end.

Benefits of Leasing a Vehicle

For some customers, leasing a car is a far more appealing option than buying for several reasons.

They include:

- Lease payments are generally lower than the monthly loan payments if you compare leasing with financing a purchase of the same car.

- A lease may require a small down payment than purchasing a car with a loan.

- You may be able to afford a brand-new car with all the features through leasing, even if you could not afford to purchase the same car.

- A lease gives you a chance to always drive the latest model vehicles as it is less expensive than buying and selling a vehicle after every few years.

- A leased vehicle is generally covered by a manufacturer’s warranty.

- You don’t have to worry about selling or trading in the vehicle at the end of the lease.

Drawbacks of Leasing a Car

Leasing is not for everyone, and it is not always a good idea.

Its drawbacks include:

- It can cost more than buying and holding on to a vehicle in the long run.

- You pay for the depreciation at the beginning of the car’s life when it depreciates the most.

- Potential fees and penalties that may cost you hundreds and thousands of dollars.

- Getting out of a lease can be expensive if you do not need the car anymore. You may not be allowed to take the car with you if you move to a different state or province.

- You cannot customize the look or features of your car during the lease. You may have to pay hefty penalties if you do it.

- You are left without a car once the lease ends.

What Credit Score Do You Need to Lease a Car?

Generally, car leasing companies prefer customers who have a credit score of at least 700. Higher scores can help you qualify for lower monthly payments. Just like an auto loan, leasing also becomes easier and less expensive if you have good credit. The cars you are allowed to lease can be limited if you have bad credit.

It is important to know that your credit score can impact your money factor, the financing charge portion of your monthly payment. Some dealers also offer leases on used vehicles, and you can go for them if you have bad credit. However, these leases come with high fees and do not offer many of the perks that come with a new car lease.

The right thing to do when considering car leasing is to improve your credit before seeking financing.

Read more: How Can I Get Out of a Lease Early?

Factors to Consider Before Leasing a Car

The language in a car leasing agreement may not be easy for you to understand and can be confusing.

Here are some of the common terms and their definitions:

- Acquisition fee – It is the upfront fee charged by the dealership or the leasing company for arranging the lease. This fee can be negotiated, or you can also look for a lease without the negotiation fee.

- Buyout price – You can end the lease anytime by purchasing the car outright. The buyout price may decrease over time as the car depreciates.

- Capitalized cost – It is the initial price of the car, also known as cap cost. This cost can be negotiated just like when you buy a car.

- Cap cost reductions – It is possible to reduce your cap cost by negotiating the price, trading in a car, or making a down payment. As you pay for the depreciation between the cap cost and the residual value, cap cost reductions can lead to lower monthly payments.

- Disposition fee – A depreciation fee is paid at the end of the lease to help cover the dealership’s costs for getting the car ready to sell. This fee can be negotiated when you return the car if you offer to buy the car, buy another car or start a new lease with the dealership.

- Gap insurance – It is the insurance that covers the difference between a car’s residual value and what your auto insurance company pays out if the car is damaged or stolen. You can purchase this insurance and include the insurance premiums in your monthly payments.

- Lease term – It is the length of the lease, which is usually two to four years.

- Mileage allowance – It specifies how many miles you can drive each year before the per-mile penalty begins. You can negotiate for a higher mileage allowance, but you may have to pay more each month.

- Money factor – Also called the lease factor, lease change, or rent change, the money factor determines parts of your monthly payment. It is often shown as a small decimal factor, but it can be converted into an interest rate by multiplying the number by 2,400.

- Purchase option agreement – The agreement often specifies for how much you can purchase the car once the lease comes to an end.

- Residual value – The value of the car at the end of the lease that may be determined by a third party.

- Security deposit – The lessor takes a security deposit that can be used to cover damage or extra mileage charges when you return the car. If you do not know any extra fees, you get the full security deposit back.

Is Car Leasing a Good Option?

If you are looking for low down payments and low monthly payments, a lease may be the best option, especially if you want to drive a latest model car. On the other hand, if you are not so particular about the vehicle model and its features, even a used car can do the job.

If you are interested in long-term savings and do not mind driving the same car for many years, purchasing may be a better option than leasing. If you want to buy a car but cannot afford a new one, a certified pre-owned car offers the same advantages at a lower cost. Deciding between leasing and buying can be a difficult decision, and you can only make up your mind after considering the pros and cons of each and how they work for you.

How to Lease a Car

If you have made up your mind about leasing, here are some steps you can take to lease a car:

- Check your credit score to ensure you will qualify for a car lease.

- Determine how much you can afford to put down and how much you can pay every month. Additional expenses for leasing a car include insurance, registration, and gas.

- Start test-driving different cars to determine which make and model you like best. Exploring options and doing your homework gives you a chance to negotiate better.

- If you are trading in a car, check out its current market value and make sure you get enough to pay off your car loan balance. You can also sell the car on your own and use these funds for a down payment on the lease. You can also negotiate the car cost and trade it separately to avoid confusion.

- Keeping in mind your driving habits, determine what mileage cap would suit you best.

- Check out a few dealerships to see which one has the best lease terms. Look for low down payments, low monthly payments, and few fees.

Leasing a car may seem challenging if you are doing it for the first time. Evaluating your finances and researching cars and lease terms is a key part of making the right choice. Once you have finalized a deal, read the entire agreement to ensure it contains all that was discussed during the negotiations to enjoy a hassle-free lease period.

If you are wondering what is a car lease, how it works, visit eAutoLease.com for detailed information. Knowing all about leasing and understanding its pros and cons can help you take the right steps and drive the car you want.